Update (October 15, 2024): The mobility budget will not be introduced. On October 15, 2024, the German Bundestag decided against it in the debate on the Annual Tax Act. Initially, the draft of the 2024 Annual Tax Act included a tax-advantaged mobility budget aimed at supporting various forms of transportation beyond public transit. We regret that this proposal was dismissed, as such an incentive would have been much-needed for companies and employees in today’s environment.But there’s good news: New mobility options can still be promoted without a mobility budget. Employers can offer tax- and social security-free non-cash benefits of up to 50 euros per month (§ 8 Abs. 1 S. 3 EStG) and flat-rate taxed non-cash benefits of up to 10,000 euros per year (§ 37b Abs. 2 EStG). Additionally, the government has been tasked with developing a comprehensive simplification of tax and social regulations for non-cash benefits—a strong signal toward reducing complexity. So, it’s still an exciting time for mobility benefits!

We’ve been hearing this question from many companies—and for good reason. Since its introduction, the Inflation Compensation Bonus, often simply called the "inflation bonus," has been a valuable financial aid for companies and employees alike, both of whom continue to grapple with rising living costs. But now, as this bonus nears its end, many businesses are confronted with the challenge of providing alternatives to their employees starting in 2025—since, of course, inflation won’t just disappear.

Let's look at the facts:

The Inflation Compensation Bonus, which has been a core part of many compensation packages, will end in 2024. It allowed companies to pay employees up to 3,000 euros tax- and social security-free in addition to their regular wages to help offset the impact of rising living costs. This measure, in effect from October 26, 2022, to December 31, 2024, has been a significant relief for many employees. Now, the question is not only whether there will be a successor but also how companies can prepare. Ignoring this challenge with an "it’ll all work out somehow" mindset may risk losing valuable talent to competitors who are better prepared.

What can companies do to replace this bonus while keeping employee satisfaction high?

Fortunately, there are various ways to compensate for the loss of the Inflation Compensation Bonus, even beyond 2024. The key is that these alternatives shouldn’t be short-term fixes but instead sustainable, flexible options that align with the demands of a constantly evolving work environment. Companies must get creative and offer benefits that truly cater to their employees’ needs.

What does that entail?

Flexibility is crucial. In a world moving faster than ever, benefits need to keep up. Employee expectations and needs are continually changing—whether due to new life stages, economic fluctuations, or social trends. A benefit that fits perfectly today may become outdated tomorrow. It’s therefore essential that companies offer benefits tailored to diverse needs and adaptable to changing conditions. The goal is to create a package as varied as the workforce itself. One thing is certain: one-size-fits-all solutions won’t work in the modern workplace.

So, what are the best options to replace the Inflation Compensation Bonus?

1. 50-Euro Benefit in Kind (up to 600 euros per year)

The 50-Euro Benefit in Kind is one of the most versatile and straightforward alternatives available. Employees can choose how to use it—whether for groceries, gym memberships, or an ICE ticket to visit friends. The advantage? It’s tax- and social security-free, meaning employees receive the full amount, while companies offer a meaningful benefit and save on payroll costs. A win-win in today’s economy.

2. Flat-Taxed Benefits in Kind (up to 10,000 euros per year)

These benefits, taxed at a flat 30% and subject to social security, can make a big impact. Imagine an employee who’s a passionate musician and has long wanted a high-quality guitar. With flat-taxed benefits in kind, this dream could become a reality. Companies can grant up to 10,000 euros annually in goods or services, whether it’s a new guitar, a home office setup, or even a trip.

3. Gift Benefits (up to 180 euros per year)

Up to three times a year, companies can gift up to 60 euros tax-free per employee. Whether it’s a café gift card for a birthday or a small token like perfume or a good book, these gestures show that companies genuinely consider employees’ needs. For companies, these gifts are also deductible as business expenses.

4. Recreation Allowance (up to 416 euros per year)

Companies can grant an annual recreation allowance, which is only subject to a 25% flat tax, plus solidarity surcharge and church tax if applicable, and remains free from social security. Though it must be associated with a vacation period, employees can use it flexibly for sports, cultural events, or other leisure activities.

5. Mobility Budget

A modern alternative to the company car, a mobility budget offers employees flexible transportation options. Companies can allocate a monthly budget for public transportation, e-bikes, taxis, or car-sharing. Starting in 2025, the government plans to implement a flat tax of 25% on mobility budgets up to 2,400 euros annually per employee.

Alongside these options, companies can offer other targeted benefits that, while less flexible, still provide meaningful daily support:

- Meal Subsidies (up to 1,500 euros per year)

- Education Subsidy (unlimited)

- Public Transportation/Deutschlandticket Subsidy (up to 588 euros per year)

- Internet Subsidy (up to 600 euros per year)

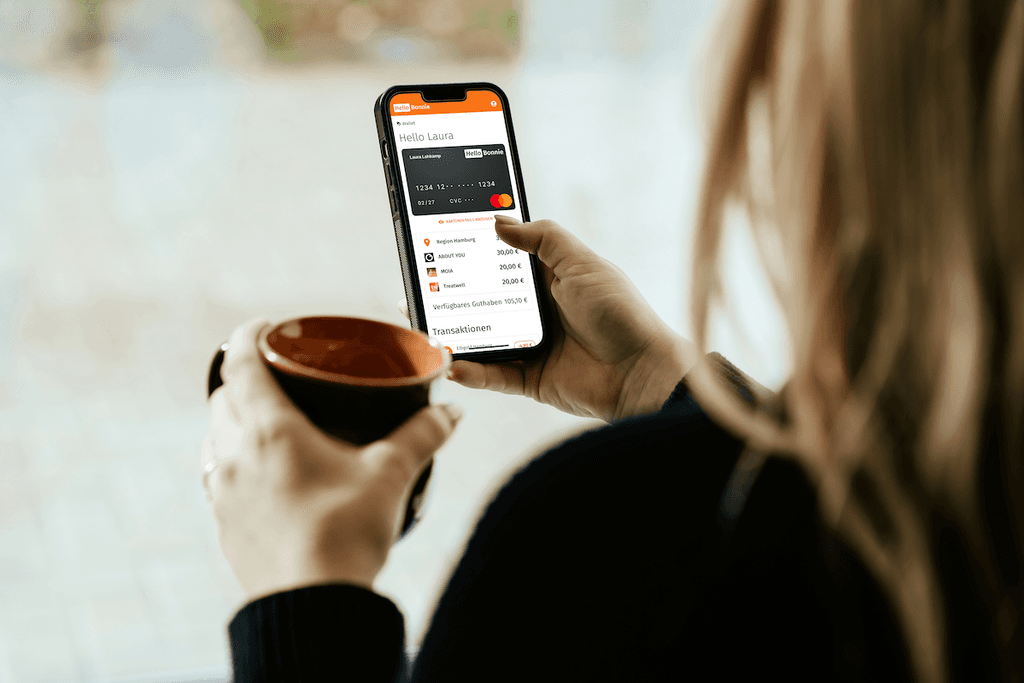

If you want to explore how to create a flexible, tax-optimized, and modern benefits package to replace the Inflation Compensation Bonus, check out HelloBonnie and get in touch with us.