One Smartcard, Flexible Benefits

Offer your team personalized benefits, boost satisfaction, and take advantage of tax benefits for your business.

Trusted by over 100+ companies

In 3 Steps

To Your Perfect Benefits

Individual benefits that integrate easily into your payroll - tax-optimized and efficient with HelloBonnie.

1. Design Benefits

Unique benefits matching your company culture. Tax-secured and integrated into your payroll system.

2. Select Benefits

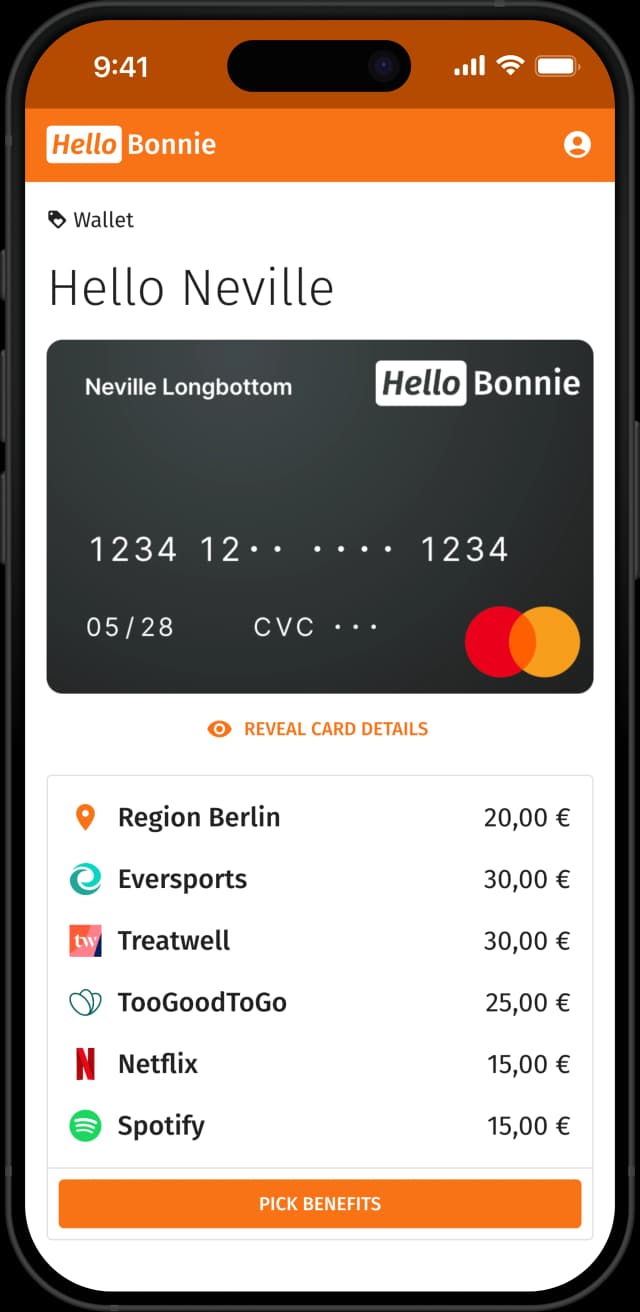

Employees choose in the HelloBonnie Wallet and flexibly distribute budget across Brand or Regional Spaces.

3. Use Benefits

Benefits always at hand – with the Smartcard in your wallet or digitally. Usable online and at regional card terminals.

Discover our Brand Spaces

Use your HelloBonnie smartcard with your favorite brand - online, in the app or directly at card terminals.

Shop locally, benefit regionally

Use your HelloBonnie Smartcard in your region – anywhere Mastercard is accepted.

Flexible Usage

Whether hair salon, supermarket or physical therapy – simply use your benefits wherever you want.

Strengthen the local economy

Support regional businesses and your favorite spots in the city.

Simple & Intuitive

No vouchers needed – use your Smartcard just like your bank card.

Optimize Payroll Costs

Find out how much your company can save

Calculate and compare your monthly total salary costs with and without HelloBonnie.

Without HelloBonnie

With HelloBonnie you save up to €6,667 per month compared to conventional salary increases (calculated based on an annual gross salary of €40,000).

Legal Notice

The HelloBonnie Smartcard was developed in collaboration with the tax consultancy firm Möhrle Happ Luther and has been reviewed and recognized as a tax-compliant benefit card through an official consultation with the Hamburg-Oberalster Tax Office and the Hamburg Financial Authority (in accordance with § 8 para. 1 s. 3 of the German Income Tax Act, R 19.6 of the German Wage Tax Guidelines, § 37b para. 2 of the German Income Tax Act). HelloBonnie does not offer tax or legal advice.

Benefits

Flexible Benefits for Everyone Involved

With HelloBonnie, everyone wins – simple, tax-compliant, and personalized. A benefits platform that inspires rather than just administers.

For Companies

Reduces payroll costs, increases employee retention, and saves time – with a digital solution that integrates into processes.

For Employees

Freedom of choice with over 200 digital brands or local options nearby. Flexible use month after month – for benefits that are truly valued.

For Partners

Position your brand as a tax-compliant benefit in kind and reach new target audiences within the HelloBonnie network.

Testiomonials

How Companies Thrive with HelloBonnie

Innovative businesses are enhancing employee satisfaction and optimizing labor costs with HelloBonnie's flexible benefit solutions.

I love giving our employees the flexibility to use the credit differently each month – one month regionally at the supermarket, the next online for concert tickets. It's fantastic that everyone can decide individually.

With HelloBonnie, we finally have a benefits solution that truly reaches everyone. The card’s flexibility allows us to cater to individual preferences – a clear improvement for our team spread across Germany.

Learn more

Your HelloBonnie Information Package

Request your personal information material free of charge and without obligation.